Eric, Ivanka

New York — Inquiries into the president and his businesses, one criminal and one civil, are being reviewed by the Manhattan district attorney and NY State attorney general in a criminal fraud investigation, according to the New York Times.

On Thursday, Nov. 19, two separate New York state fraud investigations have been launched into Trump’s tax write-offs on millions of dollars in consulting fees, some of which appear to have been given to his daughter Ivanka Trump, the New York Times reports.

Alan Garten, general counsel for the Trump Organization denied the claims in a statement to the New York Times.

“This is just the latest fishing expedition in an ongoing attempt to harass the company,” he said. “Everything was done in strict compliance with applicable law and under the advice of counsel and tax experts. All applicable taxes were paid and no party received any undue benefit.”

The independent inquiries include a criminal investigation by the Manhattan District Attorney, Cyrus R. Vance Jr, as well as a civil case by the New York State Attorney General, Letitia James. Vance’s office began their inquiry more than two years ago, initially focusing on the Trump Organization’s role in hush money paid during the 2016 presidential campaign to Stormy Daniels, an adult film star who claimed to have had an affair with Trump.

James’s civil investigation is focused on the Trump Organization’s business practices, though she can make a criminal referral and can seek authority from either Gov. Andrew M. Cuomo’s administration or the state comptroller to bring charges on her own. Her inquiry began March 2019, after Michael D. Cohen, the president’s former lawyer, told Congress that Trump had inflated his assets in financial statements to secure bank loans and understated them elsewhere to reduce his tax bill, the New York Times reports.

In August, James’s office pursued their inquiry into whether President Trump and the Trump Organization committed fraud by overstating assets to get loans and tax benefits. They asked a judge to order Eric Trump, President Trump’s son, to answer questions under oath and to hand over documents detailing daily business. Eric Trump, who is an executive vice president of the company, abruptly canceled the interview with the attorney general’s office in September, and the Trump Organization told the office that the company and its lawyers would not comply with seven subpoenas related to the investigation. In court filings acquired by the New York Times, they state that James then petitioned a State Supreme Court judge in Manhattan to compel the company and Eric Trump to cooperate, seeking to determine if President Trump and his business improperly inflated his assets “to secure loans and obtain economic and tax benefits.”

The Manhattan district attorney’s office has suggested in court filings that it is investigating possible bank and insurance fraud by the president and the Trump Organization and is fighting in federal court to obtain his tax returns.

Investigators in James’ office have scrutinized a 2010 financial restructuring of the Trump Hotel & Tower in Chicago when the Fortress Credit Corporation forgave debt worth more than $100 million. James’ office mentioned in the court documents filed in August that the Trump Organization had thwarted efforts to determine how that money was reflected in its tax filings, and whether it would be declared as income. The New York Times analysis of Trump’s financial records found that he had avoided federal income tax on almost all of the forgiven debt. The attorney general’s office is also examining whether the Trump Organization used inflated appraisals when it received large tax breaks for promising to conserve land where its development efforts faltered, including at its Seven Springs estate in Westchester County, N.Y.

“The outcome of the election will have no impact on our investigations,” James said in a television interview with MSN this month, adding “No one is above the law. We will just follow the facts and the evidence, wherever they lead us.”

James is in the latest string of New York attorney generals with whom Trump has clashed. James presided over the final stages of an investigation that led to the closing of Trump’s scandal-riddled charitable foundation. James is also seeking to dissolve the National Rifle Association, a key ally of the president.

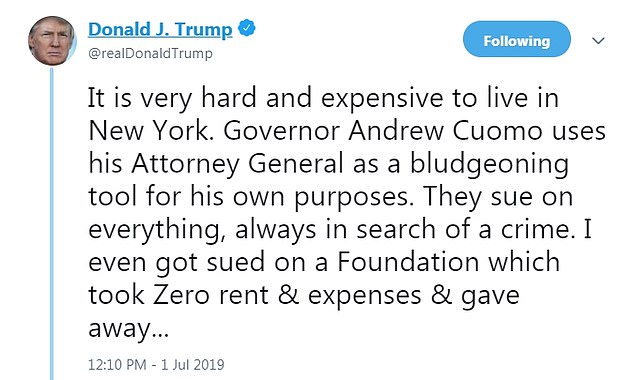

“They sue on everything, always in search of a crime,” Trump tweeted last year.

James has investigated the Trump children before, as part of a settlement that led to the shuttering of the president’s charitable foundation, where Ivanka Trump and her brothers were board members. They were ordered to receive “training on the duties of officers and directors of charities so that they cannot allow the illegal activity they oversaw at the Trump Foundation to take place again,” according to the terms of the agreement her delayed deposition of the investigation that Eric Trump called “a continued political vendetta.”

These developments follow a recent examination over more than two decades of Trump’s tax returns that reveals struggling properties, vast write-offs, an audit battle

Trump paid $750 in federal income taxes the year he won the presidency and during his first year in the White House and no income taxes at all in 10 of the previous 15 years — largely because he reported losing much more money than he made. An adverse ruling could cost him more than $100 million.

The New York Times found that some of those fees appear to have been paid to Ivanka Trump. On a 2017 disclosure Ivanka Trump filed when joining the White House as a presidential adviser, she reported receiving payments from a consulting company she co-owned, totaling $747,622, an amount that exactly matched consulting fees claimed as tax deductions by the Trump Organization for hotel projects in Hawaii and Vancouver, British Columbia.

The subpoenas were focused on fees paid to the firm on her disclosures, TTT Consulting L.L.C. — companies that Ivanka Trump was an executive officer of and that Trump’s companies made the payments to. Meaning Ivanka Trump appears to have been treated as a consultant while also working for the company. Even though companies can deduct professional fees, the IRS requires that consulting arrangements be market-based and reasonable. The tax benefit to Trump from deducting the fees on his companies’ federal returns would also be reflected on his New York returns, making it of possible interest to the state.

The New York Times reports that there’s currently no indication that Ivanka Trump is the focus of either of the investigations that the Trump Organization has claimed are politically motivated. According to Vanity Fair, the fees apparently paid to his older daughter raises questions about whether the payments were a tax-deductible way for him to compensate his children, or avoid gift taxes he might incur from transferring wealth to them.